Today we shall take a look at the USD/JPY pair. Over the past week the exchange rate of this pair has stayed mostly flat around the 113.50 level. The pair needs stronger signals in order to commit to a trend.

As usual, there is not much to support the Japanese yen. The domestic situation in Japan remains the same, though we may learn some new things about the economy as the Bank of Japan gathers for its monthly policy meeting later this week. Furthermore, the yen cannot strengthen right now because safe havens are not sought after by investors. Preliminary data about the Omicron Covid-19 variant suggests that it is less deadly than Delta. As it replaces the more dangerous variant, even though infections will rise overall, experts are more hopeful that the pandemic will come under control. For this reason, there is more risk appetite among investors, which doesn’t play out very well for the JPY.

Meanwhile, the US dollar can benefit even when the demand for safety assets is low, thanks to other factors. Most significantly, there is an expectation among market participants that the Federal Reserve will tighten its monetary policy soon. They expect this because Fed Chair Jerome Powell himself made such a promise not long ago in the context of sky-high inflation in the United States. Like the Bank of Japan, the Federal Reserve will hold its last monetary policy meeting of 2021 this week. So, by the end of tomorrow we are going to have more clarity about how hawkish-minded the Fed is at the moment. We expect the USD/JPY to remain flat until the outcome of the Fed meeting is known.

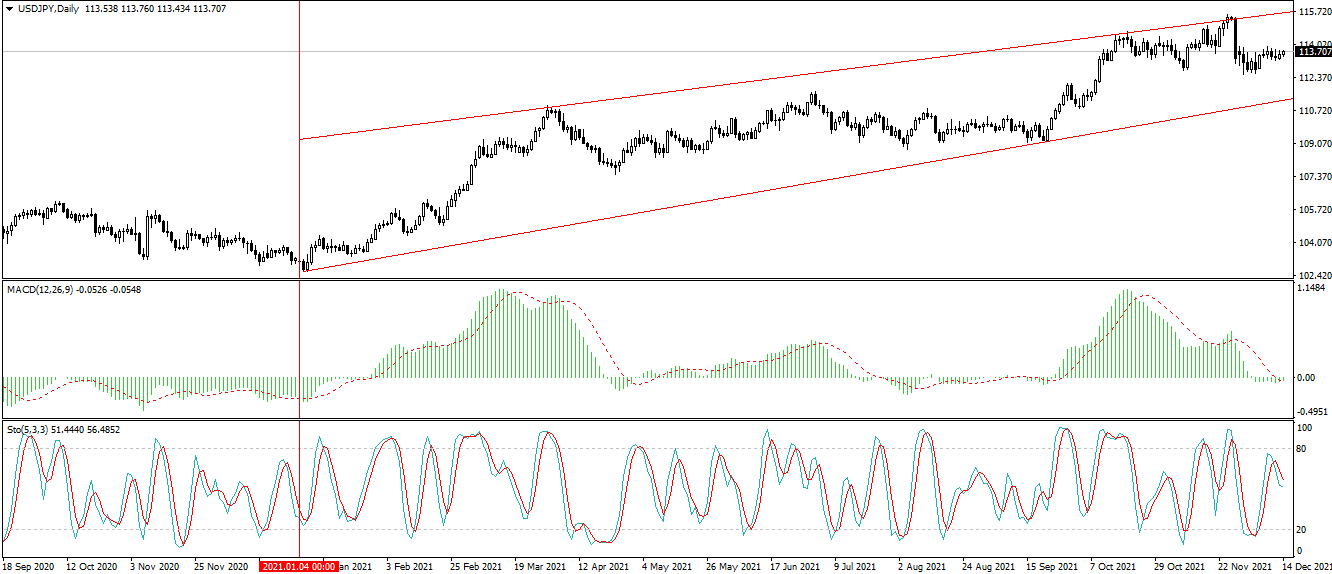

In terms of the daily chart, we have a pivot point for the pair located at 113.52, with the pair trading slightly above it currently. The support levels lie at 113.30 and 113.05, while the resistances are located at 113.77 and 113.99. The indicators of technical analysis agree in recommending a sell position today.