Today our focus will remain on Europe as we take a look at the EUR/GBP currency pair. Over the past five weeks the trend has remained almost flat, with very small fluctuations up and down. Because both currencies are under pressure, it appears it is difficult for either one of them to take charge.

The British pound does not have any perspectives to strengthen in the near future. The United Kingdom, like many other countries around the world, has been heavily hit by the coronavirus pandemic, and all of its fundamental reports have been disappointing. Thus, the UK will not be spared the upcoming recession that the pandemic will result in. In addition, the UK is under even more pressure because of its separation from the European Union at the end of this year, and the need to quickly negotiate complete trade agreements with all EU member states, which will be a difficult task. The combination of these factors means that the British pound will remain weak throughout 2020.

In all fairness, the euro is not doing much better. The economies of all countries in the European Union came to a near complete halt due to the Covid-19 lockdowns. As a result, all fundamental reports have underperformed, showing an especially strong hit to the services sector. The European Commission also expects that inflation this year will fall to 0.2%, and that the GDP will shrink by over 7%. Besides this pessimistic prognosis for the European economy, there is also the issue of a legal conflict between Germany and the ECB, which puts stimulus in question. All of these risks make the euro’s strengthening nearly impossible.

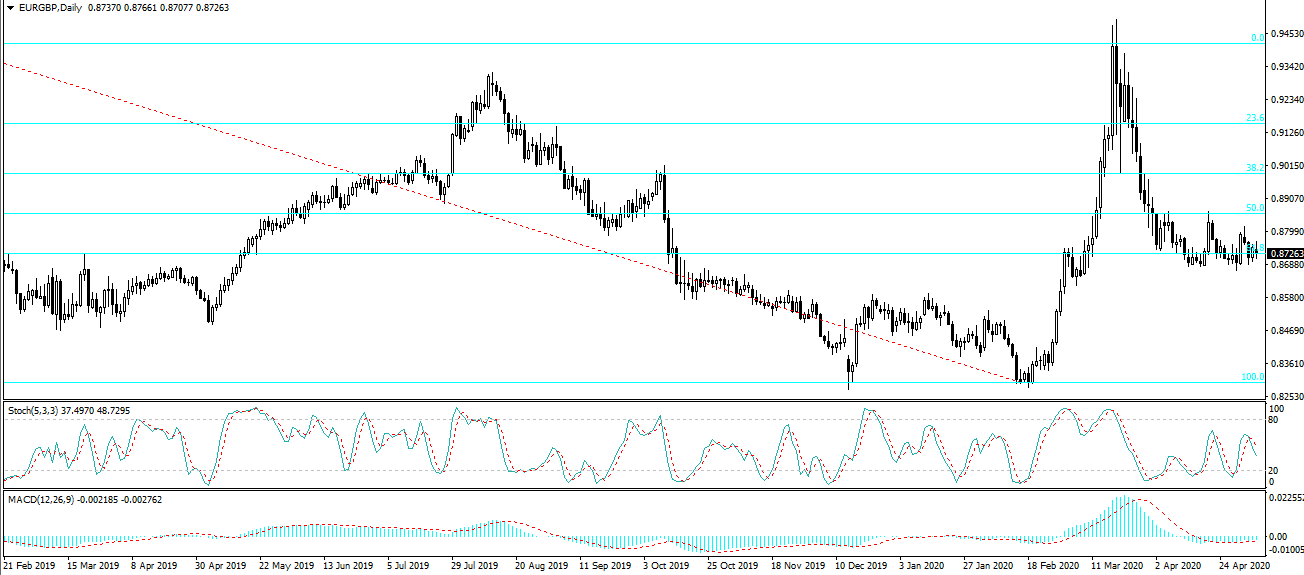

In terms of the daily chart, today we have a pivot point for the pair located at 0.8734, with the pair currently trading slightly below it. The daily support levels lie at 0.8710 and 0.8672. The daily resistances are at 0.8771 and 0.8796. The indicators of technical analysis are somewhat mixed, but ultimately recommend a sell position today.