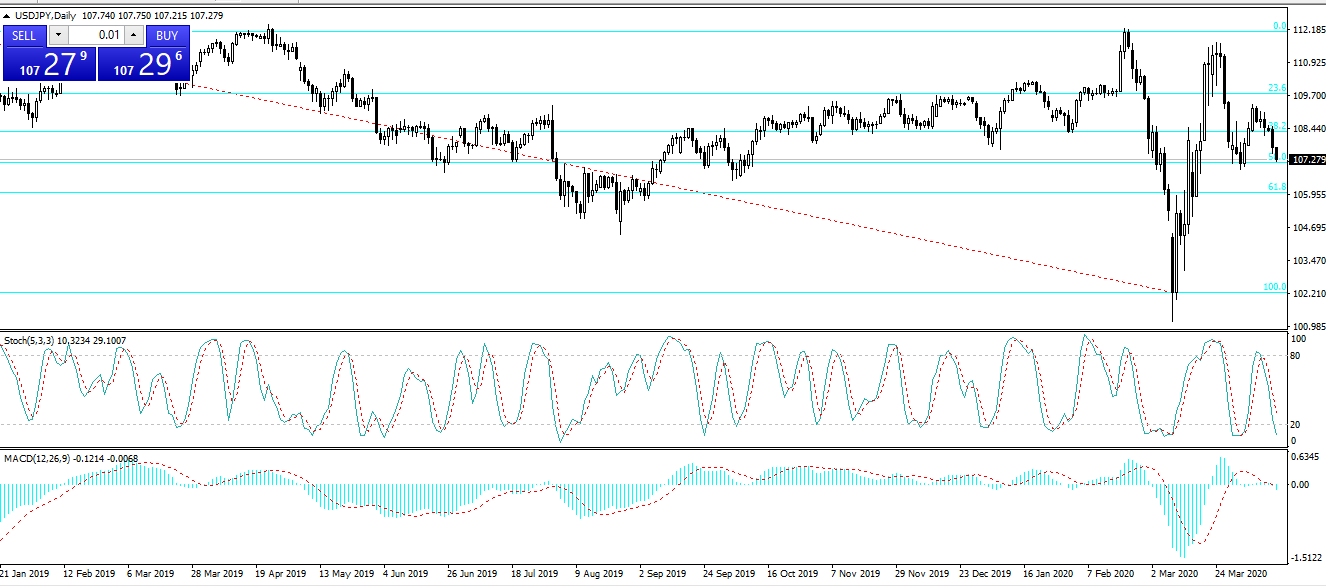

Today we shall take a look at the USD/JPY pair. The pair just underwent two rallies, the second one lower than the first, and is currently showing a downward trend.

The Japanese yen, as many traders can accurately guess, is not an asset to be underestimated in the current circumstances. Though Japan has had its own economic struggles even without the pandemic, and despite the announcement of a state of emergency last week, Japan remains stable and has so far avoided a massive Covid-19 outbreak. Moreover, the yen is a reliable safe haven instrument, so its weakness against the dollar is always short-lived. Right now the yen is prevailing over the USD, but it seems to be more related to factors that have to do with the dollar, not the JPY itself.

The US dollar is under the influence of two opposing forces at the moment. Right now, the more dominant factor is ample stimulus from the Federal Reserve and the government. Thanks to the billions of dollars both structures are pooling into the economy to mitigate the damage caused by the coronavirus pandemic, there is good dollar liquidity, pushing the USD value down. However, as more and more fundamental reports from the United States after the outbreak became serious begin to arrive, we expect to see many abysmal results, which would strengthen the dollar because it is a safety asset.

In terms of the daily chart, we have a pivot point for the pair located at 107.94, with the pair trading below it currently. The support levels lie at 107.34 and 106.90, while the resistances are located at 108.38 and 108.98. The indicators of technical analysis strongly recommend a sell position in the daily term.