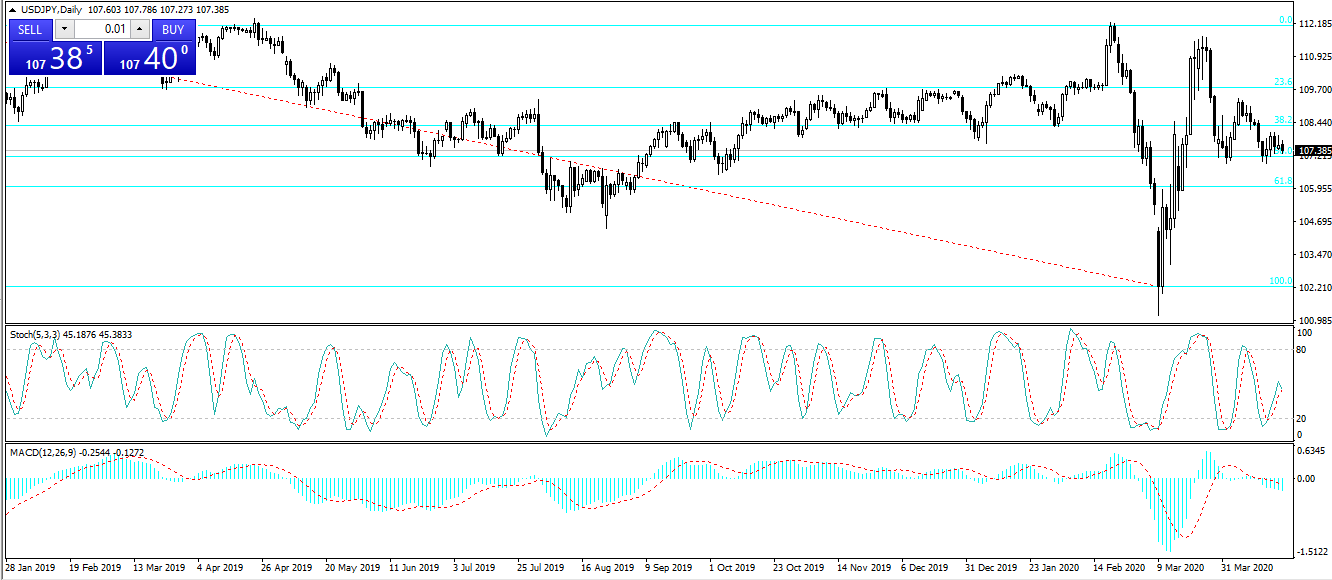

Today we shall take a look at the USD/JPY pair. The trend appears to be completing a third peak at the moment, each smaller than the previous one, showing that the US dollar cannot appreciate against the yen properly. The JPY keeps finding ways to pull the pair back to the nearby strong resistance around the 106.92 level.

The current economic situation in Japan is similar to everywhere else in the world: the news landscape is dominated by the coronavirus pandemic and how the government is fighting it. Japan only recently entered a state of emergency, despite having been exposed to the virus since January. In theory, a global recession could be terrible for Japan, considering the country was already in one even before the Covid-19 outbreak. However, the JPY is able to put up a fight against the USD despite all of that because it remains a relatively trustworthy safe haven asset.

The US dollar is in a position where it can go either way, depending on what bias prevails on the markets. If poor fundamental data (both from the United States and elsewhere) spooks investors by promising a serious recession after the coronavirus pandemic dies down, the USD could strengthen because it is a safe asset. In some regards, it is even more preferred for hedging risks than the Japanese yen. But if investors are optimistic about a faster than anticipated recovery and an end to the pandemic, then a sell-off of the dollar will bring its price down.

In terms of the daily chart, we have a pivot point for the pair located at 107.69, with the pair trading below it currently. The support levels lie at 107.42 and 107.22, while the resistances are located at 107.89 and 108.16. The indicators of technical analysis strongly recommend a sell position in the daily term.