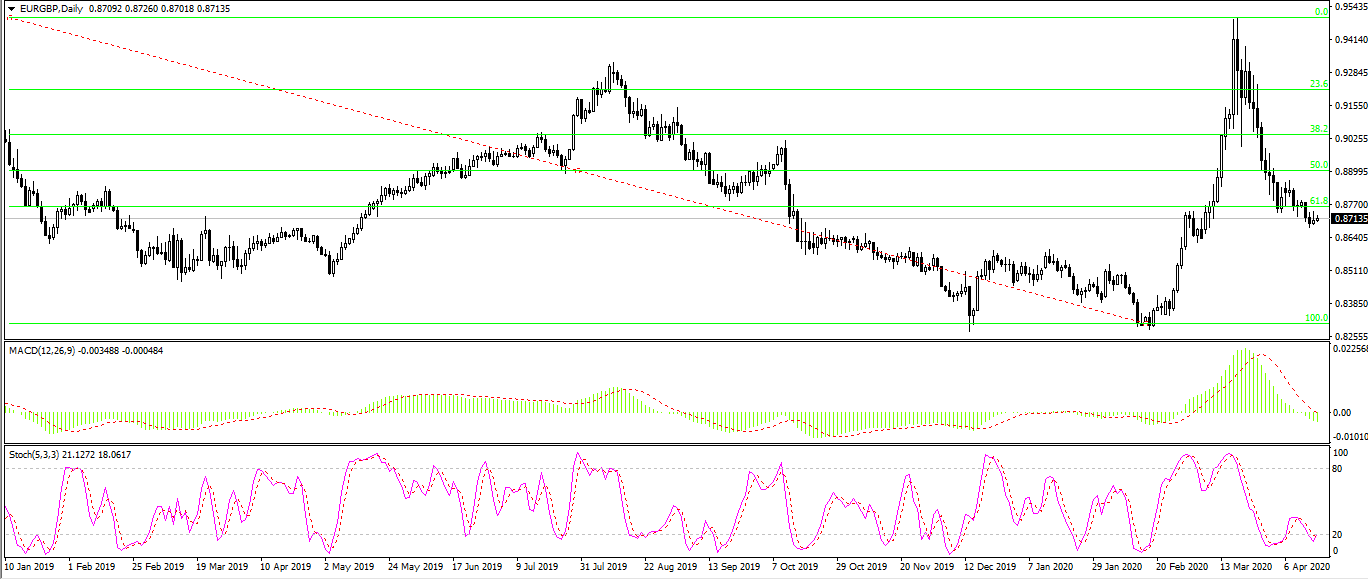

Today our focus will remain on Europe as we take a look at the EUR/GBP currency pair. Since around the middle of March, the trend has been bearish. This week it remains more or less flat, with very limited fluctuations.

The British pound is a currency with many question marks around it. At present, the biggest concern is the coronavirus pandemic, which is the case for pretty much every country in the world. Though some good news came last week as Prime Minister Boris Johnson was discharged from the hospital, having overcome the worst of the virus, the pound was not able to strengthen much. Covid-19 cases in the country keep rising; the UK economy will be under a lot of pressure in the aftermath. Moreover, even without the coronavirus, experts expected a recession in the UK due to Brexit. The island country might then experience double the negatives in its economy. In the long term, the outlook for the British pound remains bearish.

The most important reason why the EUR/GBP is trading in such a narrow corridor at the moment is that the euro itself is weak like the pound. Europe has been heavily affected by the coronavirus, yet the finance ministers of the eurozone member states have not been able to agree on a coordinated plan to counteract the impact of the pandemic. Their argument over the so-called “coronabonds” continues. Until there is unified action, the euro will be under pressure.

In terms of the daily chart, today we have a pivot point for the pair located at 0.8719, with the pair currently trading right around it. The daily support levels lie at 0.8691 and 0.8667. The daily resistances are at 0.8743 and 0.8771. The indicators of technical analysis agree on a strong sell recommendation.